Decoding Market Cycles

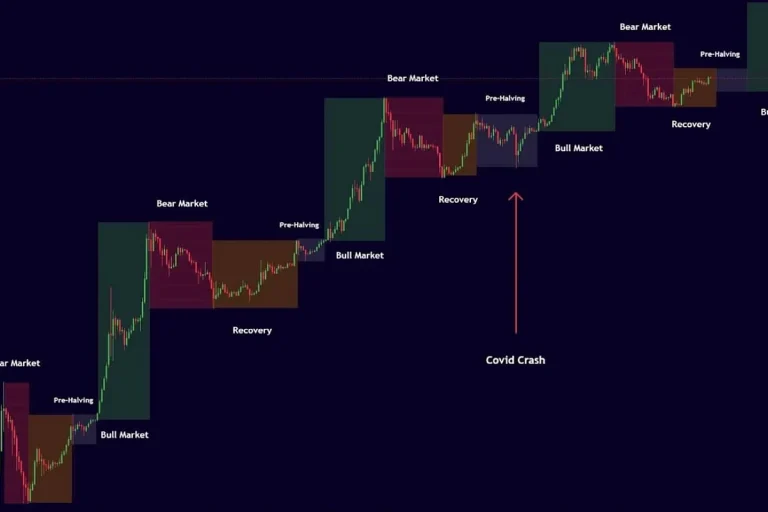

Understanding market cycles is fundamental for anyone interested in trading or investing. Markets rarely move in a straight line; instead, they go through periods of expansion, consolidation, and correction. Recognizing these phases can provide a clearer perspective on price movements and market behavior, allowing readers to interpret trends without assuming constant growth or decline. Market cycles are influenced by a combination of economic indicators, investor sentiment, and external events, making them dynamic and interconnected.

The expansion phase is often characterized by optimism and rising prices. During this period, businesses tend to grow, employment levels improve, and consumer confidence is high. Traders observing these signals may notice increased trading volumes and momentum in the markets. Understanding expansion helps contextualize bullish trends and prepares readers to recognize when the market might be entering a transitional stage.

Corrections or contraction phases occur when prices pull back after a period of growth. These periods are natural and necessary, providing the market an opportunity to adjust. Contractions may be triggered by shifts in investor sentiment, disappointing economic data, or geopolitical concerns. Recognizing these phases is critical because they highlight when the market is recalibrating rather than signaling a long-term decline.

Finally, cyclical awareness allows traders and analysts to adopt a balanced perspective. By studying historical cycles and patterns, readers can develop a framework for decision-making based on probabilities rather than emotions. While market cycles cannot predict the future with certainty, understanding them equips individuals with the context needed to interpret price changes, manage risk, and approach trading more thoughtfully.